RIPE Tokenomics

Where Early Believers Win

Every DeFi token promises "fair distribution." Then VCs dump on retail.

RIPE flips the script. Community gets tokens first. Team waits a year. Early backers paid 2 cents while builders self-funded development. Now 250 million RIPE flows to users who actually use the protocol.

One small seed round at $0.02 after 2+ years of building. Just builders who bet their own money and users who show up early.

📊 Tokenomics at a Glance

Fixed supply: 1B RIPE (mint beyond cap only if RIPE Bonds are triggered to cover bad debt)

Community first: 25% of supply goes to user incentives; this is the only bucket that begins unlocking at TGE via block rewards & bonding

All unlocks onchain: Immutable vesting contracts you can audit today

For a deep dive into how RIPE powers the protocol—including staking rewards, protocol fees via sGREEN, governance participation, and treasury building through bond sales—explore these detailed guides. Full onchain governance will launch post-TGE once the community owns sufficient supply.

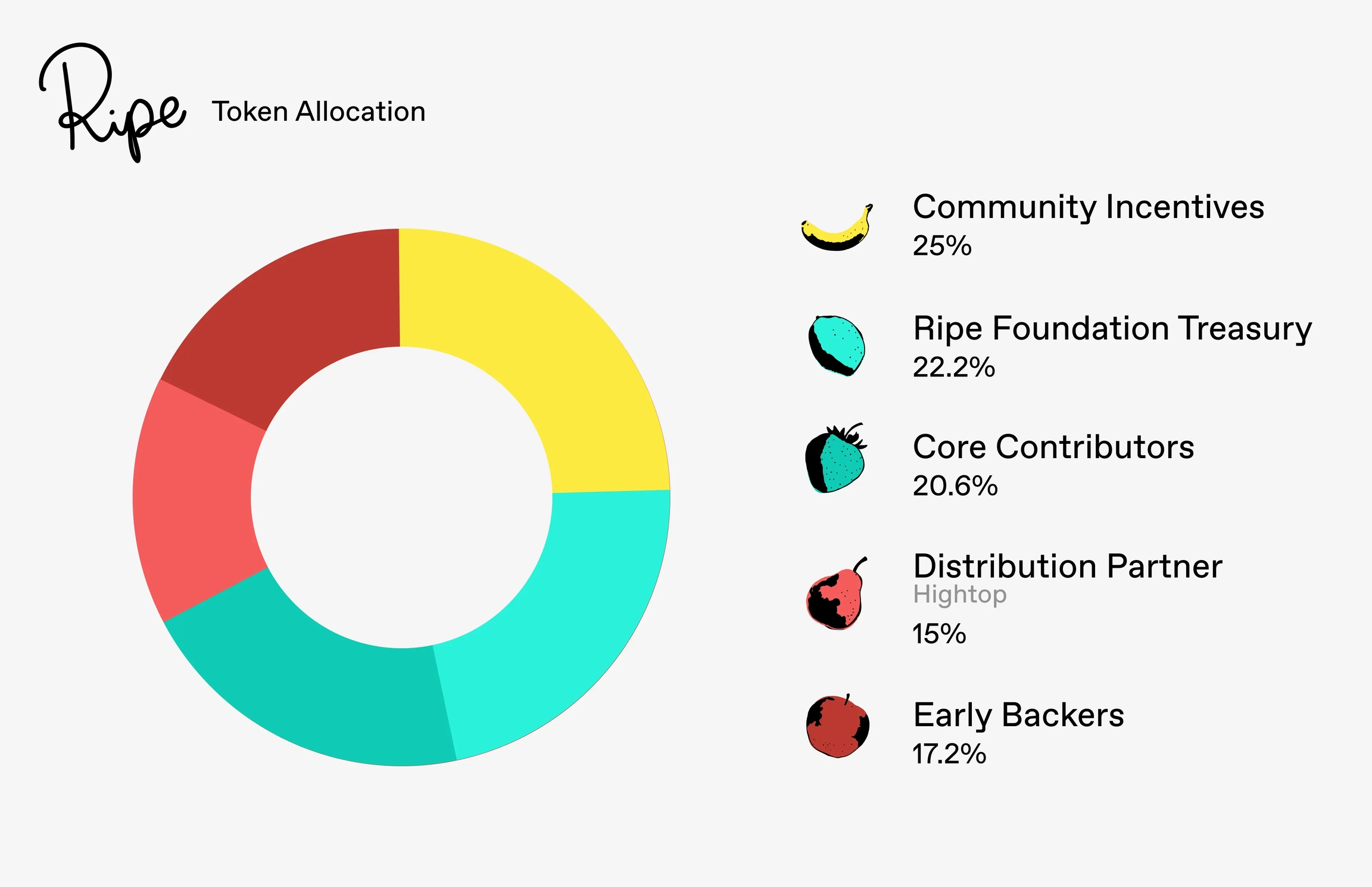

Token Allocation: Community-First Distribution

The 1 billion RIPE supply is allocated across five key stakeholder groups, with the largest portion dedicated to community incentives:

Community Incentives (25% - 250M RIPE)

Block rewards, bonding discounts, and LP rewards that directly incentivize protocol usage and growth. This is the only allocation that begins distributing at TGE.

Ripe Foundation Treasury (22.2% - 222M RIPE)

Long-term liquidity provisions, strategic partnerships, ecosystem grants, and marketing initiatives to ensure protocol sustainability.

Core Contributors (20.6% - 206M RIPE)

Compensation for 2.5 years of full-time protocol development already completed, plus ongoing development through the 4-year vesting period, ensuring the team remains committed to building and improving the protocol.

Distribution Partner - Hightop (15% - 150M RIPE)

Strategic partner providing mobile on-ramps and fiat bridges to bring Ripe Protocol to mainstream users beyond crypto natives.

Early Backers (17.2% - 172M RIPE)

Seed investors who provided capital and strategic guidance during testnet development, helping accelerate the path to mainnet launch.

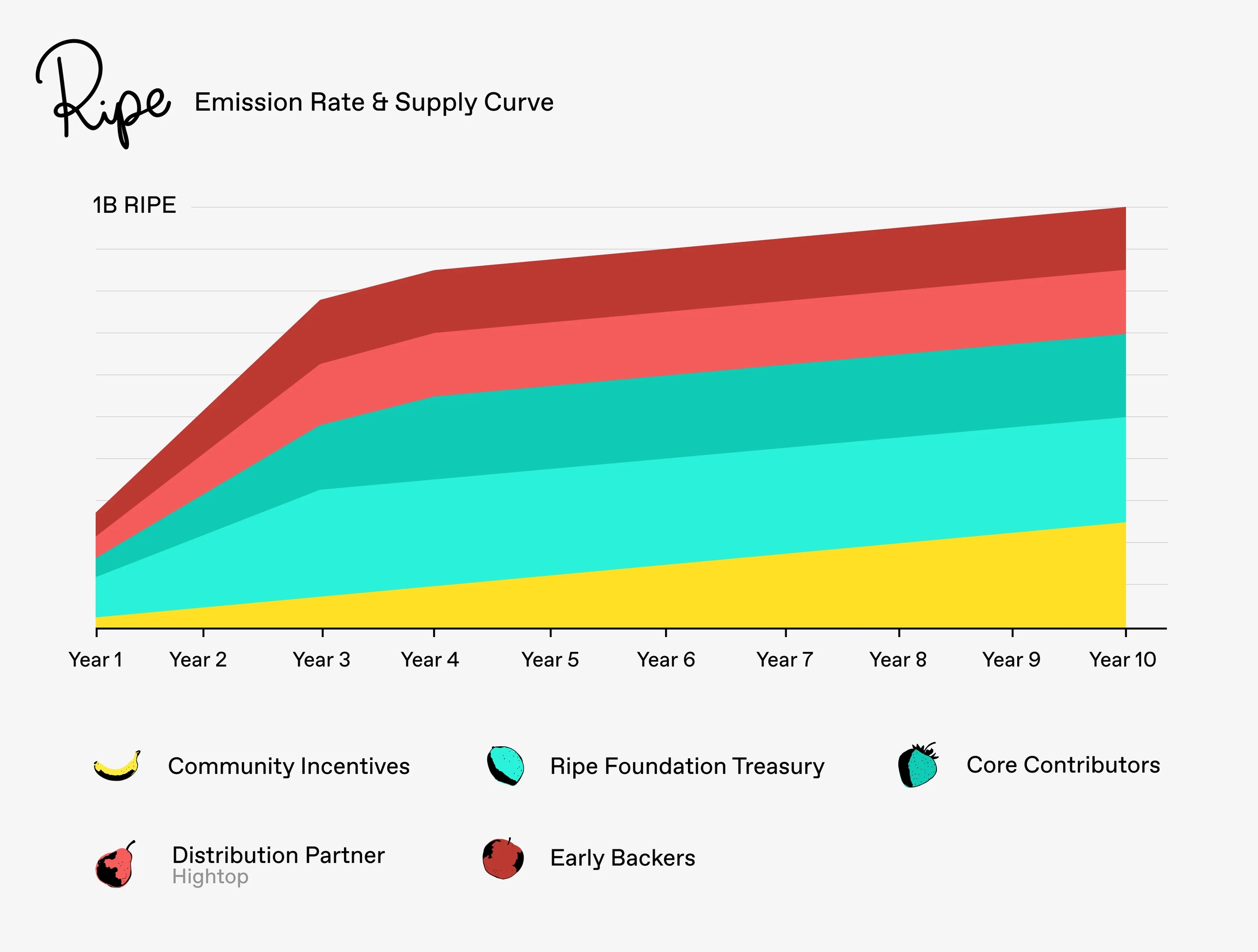

Emission Schedule: Sustainable Token Release

The graph below shows the RIPE Token emission schedule by category for years 1 to 10 following TGE.

Hard Cap with Emergency Provision

The RIPE supply is strictly capped at 1 billion tokens with one carefully designed exception: if the protocol ever needs to cover bad debt that exceeds treasury reserves, it can auction RIPE Bonds to raise funds. These emergency tokens would be minted beyond the cap, transparently diluting all holders to socialize losses fairly.

Vesting Schedules by Category

Community Incentives stand alone as the only allocation unlocking from day one, ensuring immediate protocol activity:

Community Incentives (Unlocking Now)

First Unlock: Immediate at TGE

Release Length: 10+ years

Pattern: Dynamic distribution via block rewards, bonding discounts, and governance

Core Contributors (Locked First Year)

First Unlock: 12 months from TGE

Total Length: 4 years

Release Pattern: 25% unlocked at month 12, then linear vesting over 36 months

Example: A contributor with 1M RIPE allocation receives 250K at month 12, then ~694 RIPE per day

Ripe Foundation, Distribution Partner & Early Backers (Aligned Schedules)

First Unlock: 12 months from TGE

Total Length: 3 years

Release Pattern: 33% unlocked at month 12, then linear vesting over 24 months

Example: An early backer with 1M RIPE receives 330K at month 12, then ~931 RIPE per day

Early Backers: Bootstrap to Launch

Capital Efficiency Through Self-Funding

Ripe Protocol represents a new model for DeFi development—bootstrapped primarily by its builders. Since committing full-time to the protocol, the team has deployed $1.87M in capital:

Core Contributor Funding: $1.32M

Self-funded by the founding team

Covered operational expenses, legal structure, and security audits

Demonstrates deep personal commitment to the protocol's success

Seed Round: $550K (February 2025)

Raised via Ripe Foundation at $0.02 per RIPE

Implied fully diluted valuation: $20M

First external capital after 2+ years of development

Funds ongoing operational expenses and launch preparation

Strategic Seed Investors

The seed round brought together a carefully selected group of strategic partners who share the vision for sustainable DeFi:

Institutional Partners

OrangeDAO: YCombinator alumni network (also advisor allocation)

Big Brain: Crypto-Native VC

Tetranode: Prominent DeFi investor/whale

Individual Strategic Investors

Sid Krommenhoek: Partner at Album VC

Stephen McKeon: Partner at Collab+Currency

Trevor Koverko: Founder of Sapien

Doug Leonard: Founder of HiFi Finance

AJ Taylor: Founder of Etherfuse

These early supporters bring diverse perspectives from across DeFi, helping guide the protocol's development while sharing in its long-term success through aligned vesting schedules.

How Vesting Works: Immutable Smart Contracts

Smart Contract Automation

Unlike traditional vesting that relies on lawyers and spreadsheets, Ripe Protocol enforces all token distributions entirely onchain. Each contributor, foundation member, and investor receives a personalized smart contract that:

Automatically calculates vested tokens using linear formulas

Enables claiming anytime after cliff periods pass

Locks tokens in governance vault for continued participation

Enforces terms immutably without any manual intervention

The Vesting Process

1. Token Release

Vested Amount = Total Allocation × (Time Elapsed / Vesting Duration)Tokens vest continuously—every block brings contributors closer to their full allocation.

2. Claiming Tokens

Contributors can claim vested RIPE anytime (daily, monthly, or in bulk)

Claimed tokens are minted and deposited into the Governance Vault

Tokens remain locked but gain full voting power immediately

3. Unlocking for Transfer

After the unlock period (varies by group), tokens become transferable

Two-phase security process: initiate → wait → confirm

Protects against compromised accounts and hasty decisions

Transparency & Security

Every vesting contract is visible onchain, allowing anyone to verify:

Total allocation and vesting schedule

Tokens claimed vs. remaining

Exact unlock dates

No hidden terms or backdoors

The protocol can freeze contracts in emergencies but cannot steal vested tokens. If someone leaves early, unvested tokens return to treasury while vested amounts remain claimable—ensuring fairness for all parties.

For deep technical details on the vesting system, see the Contributor contract documentation.

RIPE Value Accrual: Real Revenue, Real Buybacks

Most governance tokens are worthless. Vote on stuff, hope number goes up.

RIPE actually captures protocol revenue. Every loan fee, every interest payment — a portion goes straight to buying RIPE off the market.

How the Buyback Split Works

Protocol Revenue (Fees + Interest)

↓

┌─────────┴─────────┐

↓ ↓

RIPE Buybacks sGREEN YieldGovernance sets the split. More protocol usage = more revenue = more buybacks. Simple math.

What happens to bought RIPE? Can be distributed to stakers or burned. Either way, it's value flowing to holders instead of sitting in a treasury doing nothing.

Underscore Adds More

All performance fees from Underscore vaults? 100% goes to RIPE buybacks. The AI-powered yield strategies generate fees, those fees buy RIPE. More money working for token holders.

The Full Picture

Borrowing fees (Daowry)

Split: buybacks + sGREEN

Interest payments

Split: buybacks + sGREEN

Underscore performance fees

100% RIPE buybacks

Three revenue streams. All flowing to token holders. That's how you build sustainable tokenomics.

The Bottom Line: Own the Future, Not the Hype

RIPE isn't another VC exit scam dressed up as "community ownership."

Founders self-funded for 2.5 years. Locked for another year after launch. Early backers paid real money at a fair price. Every token unlock happens onchain where you can audit it.

But here's what matters: 250 million RIPE goes to users. Not eventually. Now. Through block rewards that started at TGE. Through bonds that let you buy at discounts. Through actual usage, not Twitter campaigns.

The protocol that wins is the one that survives. The one that survives is the one people own.

Your move.

Last updated